All Categories

Featured

Table of Contents

This beginning number mirrors the tax obligations, costs, and interest due. Then, the bidding process begins, and several capitalists drive up the rate. Then, you win with a bid of $50,000. The $40,000 boost over the initial quote is the tax obligation sale excess. Claiming tax obligation sale excess indicates obtaining the excess cash paid throughout a public auction.

That stated, tax obligation sale overage cases have actually shared features throughout the majority of states. Throughout this duration, previous proprietors and mortgage owners can contact the region and get the excess.

If the period ends prior to any interested parties declare the tax sale excess, the area or state usually takes in the funds. As soon as the cash mosts likely to the government, the possibility of claiming it vanishes. Therefore, past owners get on a strict timeline to case excess on their residential or commercial properties. While overages typically do not relate to greater profits, investors can make use of them in several means.

, you'll gain interest on your whole quote. While this element does not suggest you can declare the overage, it does aid minimize your expenditures when you bid high.

Professional Mortgage Foreclosure Overages Education How To Recover Tax Sale Overages

Remember, it might not be lawful in your state, indicating you're limited to accumulating passion on the excess. As stated over, an investor can locate methods to benefit from tax sale overages. Real Estate Overage Recovery. Since rate of interest revenue can relate to your entire quote and past proprietors can declare excess, you can leverage your knowledge and devices in these situations to make best use of returns

First, similar to any kind of financial investment, research is the essential opening action. Your due diligence will supply the essential understanding right into the homes offered at the next auction. Whether you make use of Tax Sale Resources for financial investment information or call your region for details, a thorough evaluation of each property allows you see which residential or commercial properties fit your financial investment version. A crucial facet to keep in mind with tax sale overages is that in most states, you only require to pay the region 20% of your overall proposal up front., have laws that go past this guideline, so once again, research study your state regulations.

Rather, you just require 20% of the bid. If the home does not redeem at the end of the redemption duration, you'll need the remaining 80% to get the tax deed. Because you pay 20% of your proposal, you can earn interest on an overage without paying the full rate.

Optimized Real Estate Overage Recovery Curriculum Real Estate Overage Recovery

Again, if it's legal in your state and area, you can deal with them to help them recover overage funds for an extra cost. So, you can collect rate of interest on an overage proposal and bill a cost to enhance the overage insurance claim process for the past proprietor. Tax obligation Sale Resources lately released a tax obligation sale excess product specifically for people curious about going after the overage collection service.

Overage collection agencies can filter by state, county, building type, minimal overage quantity, and optimum excess quantity. When the information has actually been filteringed system the enthusiasts can determine if they desire to add the skip mapped information package to their leads, and afterwards spend for just the validated leads that were located.

In enhancement, simply like any kind of various other financial investment approach, it uses special pros and cons.

Exclusive Tax Lien Overages Program County Tax Sale Overage List

Or else, you'll be susceptible to undetected dangers and lawful implications. Tax obligation sale overages can create the basis of your financial investment model due to the fact that they offer an inexpensive way to make cash. You do not have to bid on residential properties at auction to invest in tax sale overages. Rather, you can research existing excess and the past proprietors who have a right to the cash.

Doing so does not set you back numerous thousands of dollars like buying several tax liens would. Rather, your research, which may include avoid tracing, would set you back a fairly little fee. Any kind of state with an overbid or superior proposal technique for public auctions will have tax sale overage possibilities for capitalists. Bear in mind, some state laws stop overage choices for past proprietors, and this problem is in fact the subject of a present High court instance.

Strategic Unclaimed Tax Overages Approach Tax Overage Recovery Strategies

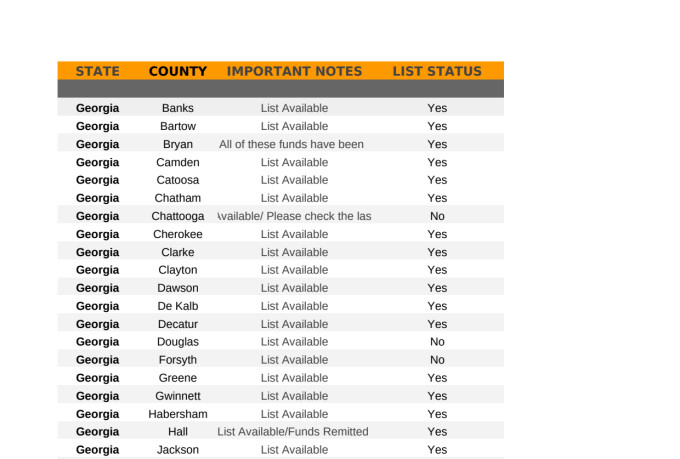

Your resources and methodology will determine the ideal atmosphere for tax obligation overage investing. That said, one method to take is gathering passion over premiums. To that end, financiers can get tax obligation sale excess in Florida, Georgia, and Texas to capitalize on the costs bid laws in those states.

Any type of public auction or foreclosure including excess funds is an investment possibility. You can spend hours investigating the previous proprietor of a residential property with excess funds and call them only to find that they aren't interested in going after the cash.

You can begin a tax obligation overage service with minimal expenditures by finding information on recent residential properties cost a premium proposal. You can call the past proprietor of the residential or commercial property and supply a cost for your solutions to aid them recover the overage. In this circumstance, the only expense included is the research study as opposed to investing tens or hundreds of countless bucks on tax obligation liens and deeds.

These overages usually generate rate of interest and are available for previous owners to insurance claim - Tax Auction Overages. Whether you invest in tax liens or are only interested in cases, tax sale excess are financial investment opportunities that need hustle and strong research study to turn a revenue.

Five-Star Overages Surplus Funds Blueprint Bob Diamond Overages

An event of rate of interest in the residential property that was cost tax sale may appoint (transfer or sell) his or her right to claim excess earnings to another person just with a dated, written record that explicitly specifies that the right to claim excess proceeds is being designated, and only after each party to the proposed job has disclosed to every other party all facts associating with the worth of the right that is being appointed.

Tax obligation sale overages, the surplus funds that result when a home is marketed at a tax sale for even more than the owed back tax obligations, fees, and costs of sale, represent a tantalizing chance for the original homeowner or their beneficiaries to recover some value from their lost asset. However, the procedure of asserting these overages can be intricate, bogged down in lawful treatments, and differ significantly from one territory to one more.

When a residential property is marketed at a tax obligation sale, the main objective is to recover the unsettled building taxes. Anything over the owed quantity, consisting of penalties and the price of the sale, becomes an excess - Best States for Tax Overages. This overage is essentially cash that ought to truly be gone back to the former homeowner, assuming no other liens or cases on the property take precedence

Latest Posts

Delinquent Tax Foreclosures

Risks Of Investing In Tax Liens

Tax Liens And Foreclosure